Category — zz. Even Geekier than Usual

End of Summer 2018 Crowds at Walt Disney World

This site’s Disney World crowd calendars always show crowds dropping off in later August.

For example, in 2018, crowd rankings go from 8/high-minus at the end of July/beginning of August down to 2/lower in early September.

This page both explain how that comes about and also reviews how the site’s crowd calendars are built.

END OF SUMMER 2018 CROWDS AT WALT DISNEY WORLD

The highest-crowd periods at Walt Disney World all have one thing in common: they are convenient times for parents to take their kids to Orlando. That is, they are times that kids are out of school and that parents traditionally can take off of work.

What’s not so clear until you do the numbers is that actual school vacation dates are much more varied than you’d think. And there’s no good source you can go to that explains what all these varied dates are.

So usually every year about this time one of my nieces goes to hundreds of school district websites and captures all the key vacation dates for the upcoming academic year.

(This time of year because you’d be surprised many districts don’t put their calendars up for the upcoming year until June, even late June–looking at you, New Jersey…)

This year we collected data on 274 school districts with 15.33 million kids–about a third of the US school-age population. These include the 100 largest school districts in the U.S., plus 170+ more of the next largest school districts mostly in the more highly-populated states east of the Mississippi–that is, the states from which in particular Walt Disney World draws its visitors.

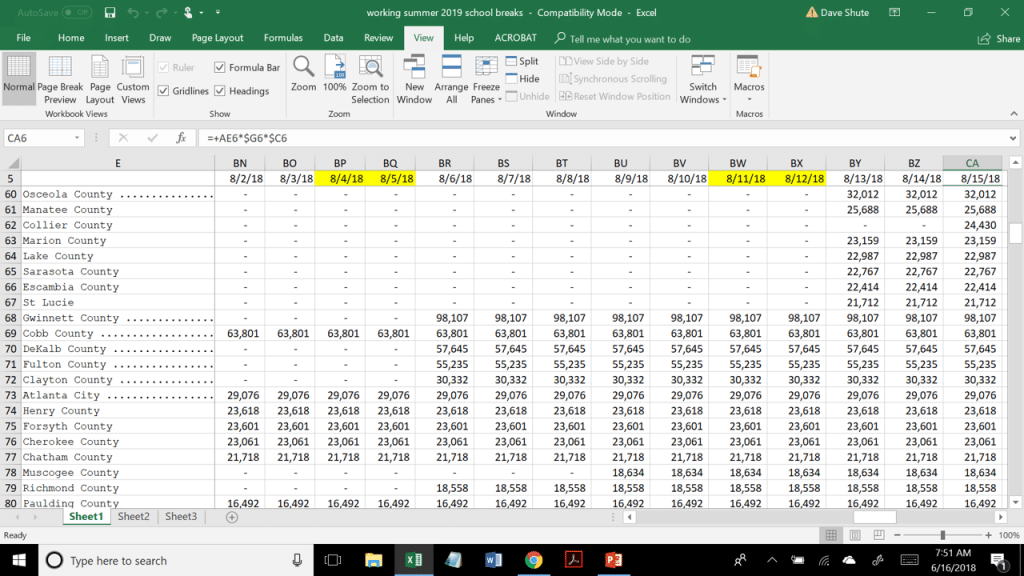

I then create a database that shows based on district enrollment every kid who is off on every date, and weight each district based on that district’s state’s proportion of total US visits to this website (because Disney won’t tell me actual visitation by state!). See the image above for a screenshot example.

Finally, I calculate percentage of total weighted kids on break by date and use that to inform the crowd calendars.

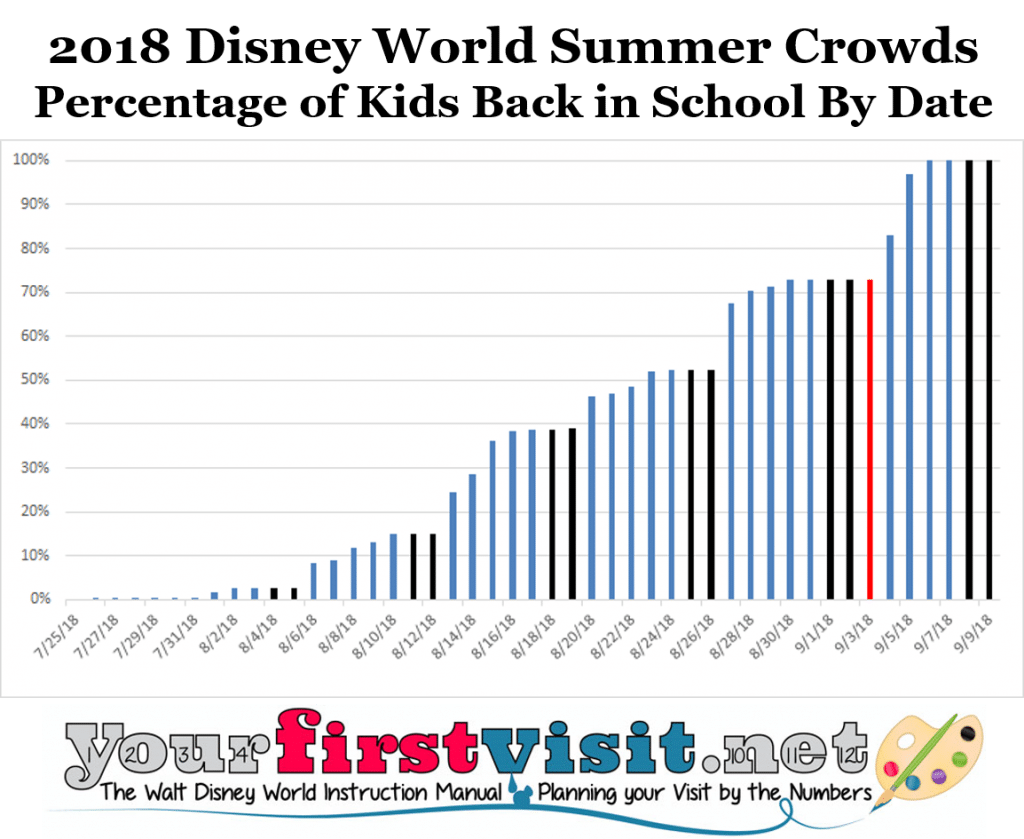

So you can see that

- Kids don’t start going back to school in real numbers until Wednesday 8/8

- More than a third are back in school by 8/15

- About half are back in school by Thursday 8/23 and

- More than 70% are back in school before Labor Day (noted in red)

In 2018, pretty much all kids are back in school by the Thursday after Labor Day.

Moreover, vacation patterns typically don’t have people returning from their vacation the night before school begins, so the effect of these back-to-school dates is offset into earlier August by around a week.

Thus, in the 2018 crowd calendar, the week of 7/28 and 8/4 are rated 8/high-minus crowds, the week of 8/11 7/moderate+ crowds, the week of 8/18 6/moderate crowds, and the week of 8/25 3/low crowds.

As I turn to revising my draft 2019 crowd calendar, I’m also adjusting for some small shifts based on co-author Josh’s work on easyWDW.com. In retrospect, in the summer of 2018, the week beginning 8/11 should be an 8/ high-minus, 8/18 should be a 5 moderate-minus, and 8/25 a 2/lower.

Follow yourfirstvisit.net on Facebook or Twitter or Pinterest!!

June 16, 2018 11 Comments

Star Wars: Galaxy’s Edge Forecasts: Crowd Levels, Impact on Other Disney World Parks, Opening Date, etc.

Note: on March 7, Disney announced that Galaxy’s Edge will partially open on August 29, 2019.

- What will it be like in the new land itself?

- What will it be like in the rest of Disney’s Hollywood Studios?

- What impact will the opening have on the rest of the Disney World parks?

- When will it actually open?

To some, the answer to the first three questions will be “horrible,” and to the fourth “August 29th, sorta.” But by looking at roughly analogous openings, you can develop a more nuanced set of forecasts.

In September 2017 when I published my first draft 2019 crowd calendar, I noted the following

“There’s no formal opening date for this land — “late 2019” is the rumor. I expect it to unfold much like Harry Potter did at Universal–with crushing crowds in the actual land, but not a huge spillover effect on the other parks–or even the rest of Hollywood Studios. If I’m wrong, expect to see an increase of a point or two in the crowd levels after it opens.”

What’s new since then is a better sense of the astonishing impact of Pandora on Disney’s Animal Kingdom.

So here’s my current forecast for Galaxy’s Edge.

1. WHAT WILL IT BE LIKE IN STAR WARS: GALAXY’S EDGE?

This is the easy one to forecast. Galaxy’s Edge itself will be crushed with those interested in the Star Wars setting and its Millennium Falcon and battle rides for quite some time. I expect longer hours, daily Extra Magic Hours, and the use of FastPass+ or some other mechanism to restrict access to the actual land, not just the rides, but there will still be more demand to visit the land than capacity to serve it.

2. WHAT IMPACT WILL STAR WARS: GALAXY’S EDGE HAVE ON THE REST OF DISNEY’S HOLLYWOOD STUDIOS?

Here I need to revise my September 2017 forecast a bit. I now expect the other “adult” rides in the park (e.g. Tower of Terror, Rock ‘n’ Roller Coaster, Star Tours) to see longer waits than I had initially thought. Visitors avoiding both the thrill rides and the new Star Wars rides should be OK, but everyone else will see substantially increased waits at the Studios.

Based on what has happened at Pandora, I now expect an annualized growth in attendance at the Studios after Star Wars opens of on the order of at least 4 million more visitors, bringing the park to (after what I expect to be the impacts of Toy Story Land and Mickey and Minnie’s Runaway Railway, another million visitors*) to an annualized run rate of about 15.5 million visitors, or almost 50% more than it saw in 2017.

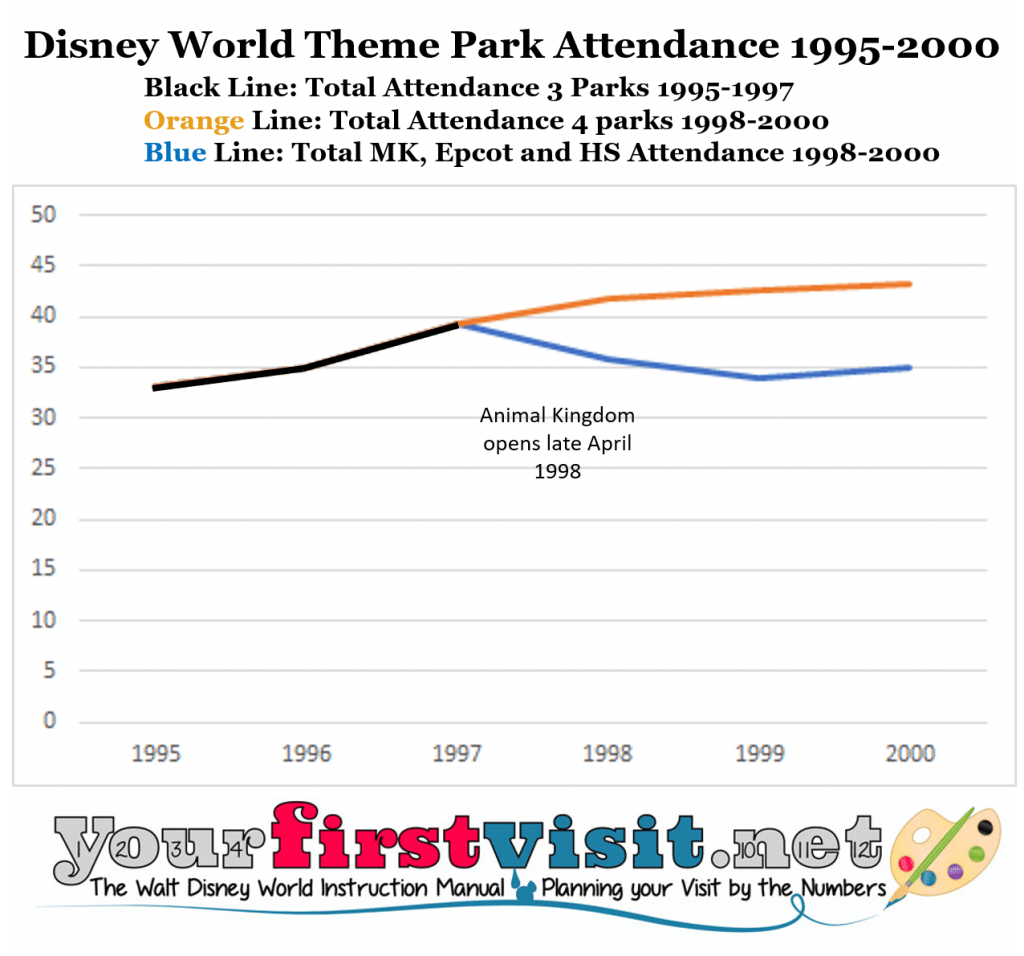

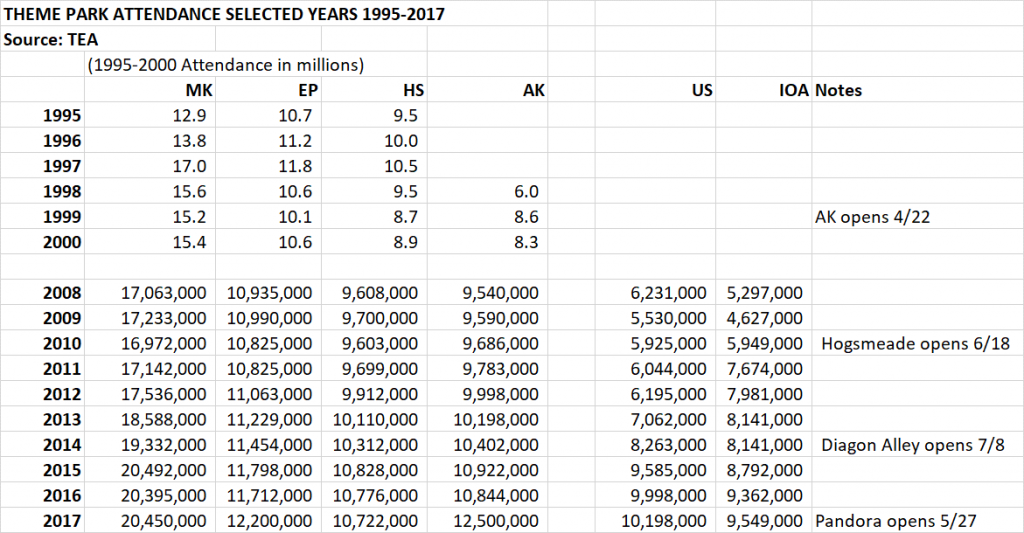

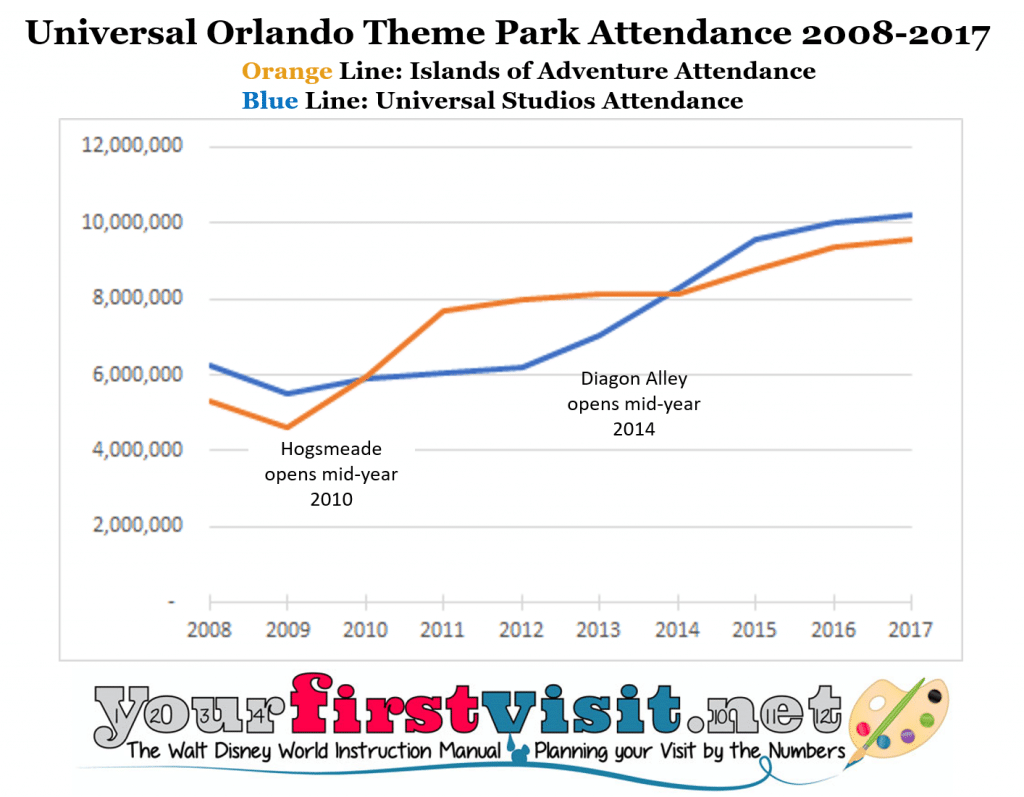

Where does my four million come from? Well, here’s the increase in the relevant park’s attendance for the 12 months following** some recent major openings:

- Pandora (2017): 2.75 million

- Diagon Alley (2014): 2.4 million

- Hogsmeade (2000): 2.65 million

- The Animal Kingdom itself (1998): 8.6 million

So I am forecasting for Star Wars: Galaxy’s Edge basically an opening near the scale of the Animal Kingdom’s opening, but divided across the two North American parks.

This makes the opening of Star Wars at Hollywood Studios almost a 50% larger opening than Pandora, and 60% larger than the average opening of the Harry Potter parks. Star Wars itself is a much more popular property than Pandora, and it will offer two world-class rides, rather than Pandora’s one world class ride and one also-ran.

On the other hand, Disney World Galaxy’s Edge attendance will be diminished by first the fact than an equivalent land will open earlier in California, drawing off some potential attendance, and second by the horror stories I expect to come out of Disneyland, leading some to defer attendance until later years.

Hollywood Studios park hours can fairly easily be expanded to the 14.5 hours/day we see this summer at Animal Kingdom, or more. Assuming its shows can have the number of times they are offered increased proportionality, this can add depending on the time of year 20-30% to its capacity, absorbing a couple million of the new visitors.

At that level of operating hours, the five new rides that will open at Hollywood Studios between now and then (the two Toy Story rides, the Mickey and Minnie ride, and the two Star Wars rides) will open additional capacity of about 100,000 individual rides a day. On average this equates to either 2+ rides for all 15.5 million visitors or about 7 rides per day for each of the 5 million new visitors. So on the math, the park can take this level of increased attendance.

The problem will be mismatches between supply and demand at individual attractions—especially at the two Star Wars attractions.

I get about enough capacity for every visitor to the park to see just one of the Star Wars rides on an average day. If more than half of park visitors want to see both of them, lines will skyrocket, and some of the Star-Wars aimed folks will balk at waits for those rides and go elsewhere in the park. And since I expect a fair proportion of the dedicated Star Wars visitors to not be interested in equal measure in the new capacity at the Toy Story Land rides or Mickey and Minnie’s Runaway Railway, the result will be heavy lines at the rides most popular for adults—Rock ‘n’ Roller Coaster, Tower of Terror, and Star Tours.

3. WHAT IMPACT WILL STAR WARS: GALAXY’S EDGE HAVE ON THE REST OF THE PARKS?

Everyone seems to think that the opening of a major land (or ride) has immediate spillover effects on the other parks. That simply has not been the case for Florida parks.

- When Disney’s Animal Kingdom opened, attendance at the other three parks remained flat for the next two and a half years. (Reasonable analysis covers only through 2000, as 9/11 makes comparison to 2001 too different. Attendance at the other three parks actually dropped substantially in 1998, but this was an artifact of Disney’s 25th anniversary celebration, which boosted all of 1997 but only bits of 1996 and 1998.)

- When Hogsmeade opened at Islands of Adventure, Universal Studios remained flat for two and a half years

- When Diagon Alley opened at Universal Studios, Islands of Adventure saw no increase the year it opened, and went up only 8% the next year

- When Pandora opened, the attendance in the other three Disney World parks remained flat

4. WHEN WILL STAR WARS: GALAXY’S EDGE ACTUALLY OPEN?

Note: on March 7, Disney announced that Galaxy’s Edge will partially open on August 29, 2019. No one yest knows when the land will be completely open. The material below may be helpful in establishing that…

The word from Bob Iger last September was that Star Wars: Galaxy’s Edge would open at Disney World after the end of Fiscal 2019 but before the end of calendar 2019—that is, sometime in October through December. More recently the word is the Disneyland’s version will open in “summer” 2019 and Disney World’s version will open in “late fall.”

This last is more ambiguous than you might think, as there are at least four valid definitions of fall and no real meaning to the word “late.”

And the ambiguity is likely intentional, as it gives Disney some scope to be late in its plans. I would expect the Disney World version to open at least 120 days after the Disney Land version opens—to give Disney World time to learn from operating patterns in California well before it opens up FastPass+, which, given Annual Pass Calendars for Disneyland in June 2019 suggests no earlier than mid-October 2019.

By some of the four possible definitions of fall, that is also more than halfway through fall, so it suits the “late fall” concept. Mid-October is largely past the Columbus Day-focused fall break season at Disney World, and begins a period of two months when only one week—Thanksgiving week—sees really heavy crowds. While Disney has shown willingness to open rides during high crowd periods (Seven Dwarfs Mine Train and Pandora both opened over Memorial Day weekend, a period more crowded than any between October 15 and December 15 except Thanksgiving week), it is operationally simpler to avoid such periods for opening.

Winter begins, depending on which definition you are using, during the period from early November through December 22, 2019. Given the value of some lower-crowd operating time, I’d think the latest thoughtfully projectable date for opening would be soon after Thanksgiving 2019, so that for now creates an opening period of mid-October to late November, but not likely Thanksgiving week itself.

Note that Kelly can help you book your DIsney World trip-either aiming at Star Wars: Galaxy’s Edge, or aiming to avoid it. Use the form below to contact her.

*I get the increment from Toy Story Land and Mickey and Minnie’s’ Runaway Railway by comparing them to the openings of New Fantasyland and Seven Dwarfs Mine Train, each showing an increment of about a million visitors, and then dividing by two for the Studios being a less intrinsically attractive park than Magic Kingdom.

**Annualized rates are calculated by taking first year increases, dividing by the number of open days, and then multiplying by 365. All data is from TEA . The numbers are above, and an excel version of them is here.

Follow yourfirstvisit.net on Facebook or Twitter or Pinterest!!

June 10, 2018 24 Comments

Length of Stay Pricing at the Disney World Resorts?

Earlier this year Disney World announced that parking at its hotels would no longer be free for reservations booked after March 20, 2018. Only slightly less controversial than that whole poenitentia vs. metanoia thing among Luther, Erasmus, and the Catholic Church, no explanation for it has been offered other than such a parking charge is common practice.

At the end of my post on the parking matter, I’d noted that “I can think of one way in which–at least in 2019–this money may make its way back into guest pockets. I’ll publish more on this thought, which has to do with length-of-stay pricing, later.”

So this is the post on that thought. What it boils down to is that if Disney institutes length of stay discounts, it would need to make a big one-time increase in room rates to keep its overall revenue whole. The increases from parking revenue could be used to offset some of that price increase.

“We’ve got … a number of other plans as it relates to our hotel business. So we think that we’ve got room on pricing there. It’s not just about taking pricing up, it’s just about being more strategic at how we price, particularly how we manage demand and we’ve taken a number of steps there. We think we can expand length of stay …We have some nice pricing leverage with our hotels. We actually are comping nicely in hotel rates, particularly in Orlando as a for instance, but we have an opportunity to expand [length of stay].”

Bob Iger, CEO The Walt Disney Company, in the Q2 17 earnings call (May 9 2017)

Bob Iger noted about a year ago opportunities he saw to expand length of stay at the Walt Disney World hotels. One way to expand length of stay is through pricing mechanisms that reward longer stays.

Such a pricing mechanism can be as simple as giving a discount off of what would otherwise be a hotel’s rates in return for booking a stay of a certain length.

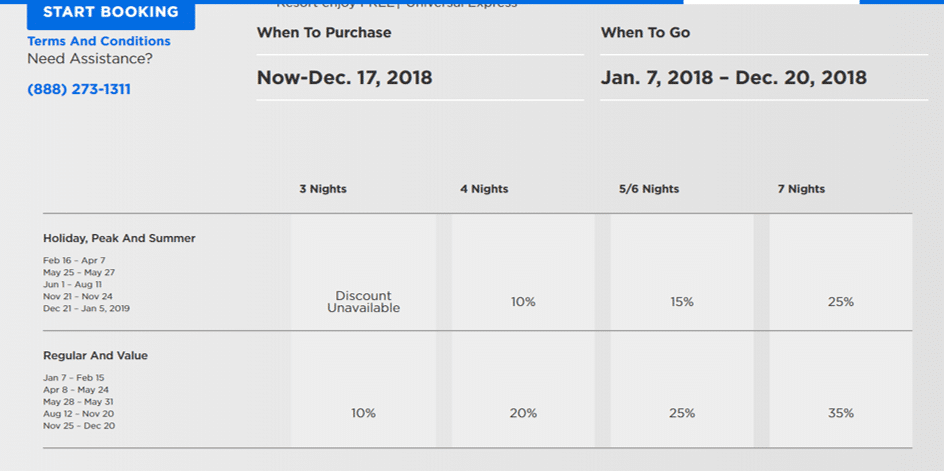

This is in effect what Universal does—it has its set of prices per night, but then takes a certain amount off of what would otherwise be the total if you book certain stay targets.

See the image—for example, on its far right, you’ll note that a seven night stay can be as much as 35% off what would otherwise be the sum of the nightly prices. That’s a big discount, in effect almost two and a half free nights (35% of seven nights= 2.45 nights).

Length of stay pricing can be meant to build a hotel’s occupancy—that is, add room nights—or to shift the current set of room nights to a group that has on average a longer length of stay.

If a hotel has plenty of rooms available and not many “typical” bookings already at the stay lengths at which the discounts kick in, then the goal would be to add room nights. High discounts might be accepted to do so, as little revenue would be lost from the few guests who already would have booked longer than the “typical” stay, and the new revenue from the extra nights would largely drop to the bottom line, since the variable costs of an extra night in a room are pretty low.

Length of stay pricing in already well-occupied hotels—as the Disney hotels are, recently reporting yet another quarter of occupancy in the 90% range—has a very different and more complicated dynamic.

Here you have different goals than increasing occupancy (because you have so little room to do so) and much less flexibility in discounting longer stays (because you are discounting many room nights that you could have sold at their regular rates).

The goal instead might be to convert the same number of room nights from shorter to longer stays, as longer stays are typically more profitable (as they spread the one-time costs of a single booking/check-in/check-out over more nights).

Or, if there is a value difference between shorter and longer stays not already captured in pricing, the goal might also be to use length of stay pricing to price shorter stays higher to extract more of the value they create. For example, Disney might be expecting Star Wars: Galaxy’s Edge, expected to open in the last quarter of 2019, to increase the demand for shorter stays from those guests coming to experience only it.

So if Disney were to institute length of stay pricing (as a typical practice, like Universal–not as a one-time deal), given high occupancies and already longer lengths of stay than Universal, I’d expect a couple of features to their program

- The deals to kick in after longer stays—for example, after five or six nights, not the three or four that Universal offers

- A lower discount curve—one that still begins at 10%, perhaps, but that doesn’t get nearly as high as 35%, other than as a temporary promotion that replaces other typical Disney World hotel deals

- A one-time price increase for the base set of undiscounted prices, so that revenue stays whole over most trip lengths.

This last point is the key one, so let me illustrate it with an example.

Let’s say Disney offers 10% off the total price of a room that would before the one-time price increase average $250 a night (in this example, thus a moderate), beginning with a six night stay.

To keep the same $1,500 revenue over the stay, average pre-discount prices would need to go up in a one-time price increase by 11% (the formula is 1/(1-discount percentage) – 1).* At a new price $278 a night, a 10% discount off the new total of $1,668 would yield the same initial $1,500 revenue.

In other words, when the hotels are essentially full and the goal is simply to lengthen average length of stay, you don’t want to give up revenue to do so—otherwise you simply lose money on the extensions.

Disney World usually announces its new hotel prices for the coming year in the summer, and while it varies across hotels, room types, and times of the year, prices commonly go up 4%+. If it used its summer 2018 pricing announcement to include for 2019 both typical price increases and also a one-time price increase meant to keep it whole after length of stay discounts, then in my example undiscounted prices would go up ~15%.

That’s a pretty big number—a headline grabbing number. How could Disney avoid some of those headlines? Well, one way to do it would be to institute a one-time price increase for something else related to the hotels, and use the revenue from it to offset the needed hotel room price increase. Like parking.

For median priced standard-view rooms, the new parking charge amounts to an average increase across 2018 (you get about the same results if you use just the last 7 or 8 months of 2018) of around 8% at the value resorts, 7% at the moderates, and 4.5% at the deluxes. So if half of guests pay for parking, then Disney World already has in hand price increases of 2.25 to 4%. It can use these already-existing one time increases to offset some of what it would otherwise want to do to 2019 prices, and perhaps (other than at the deluxes) even get the 2019 increase below 10%, which would help the headlines a bit…

Note that there are other ways to incent longer lengths of stay.

For example, since both shorter and longer Disney World stays tend to include weekends, Disney could make the price difference between weekends and weekdays even sharper than it already is.

For some time now, many, but not all, Disney World resorts have had higher prices on Friday and Saturday nights during many, but not all, price seasons.

And for the 2018 pricing year (released not long after Iger’s comments noted above) Disney also made Sunday and/or Thursday prices higher than the rest of its weekday prices at some resorts during some price seasons (gory details here).

Continuing this approach with even sharper differences between higher and lower priced nights would certainly either dis-incent and/or capture more value from shorter trips that include these higher priced nights. I’m not sure, though, that sharper differences would have much effect on lengthening stays, as—at least now—Disney does not inform you of the cost of adding a room night.

*The increase actually needs to be less than this, as those on shorter stays pay its full value. But for me to estimate how much less, I’d need data on the distribution of bookings by length of stay, which I don’t have, so I am ignoring this issue.

Follow yourfirstvisit.net on Facebook or Twitter or Pinterest!!

April 9, 2018 4 Comments

Fun with Buses at All-Star Music

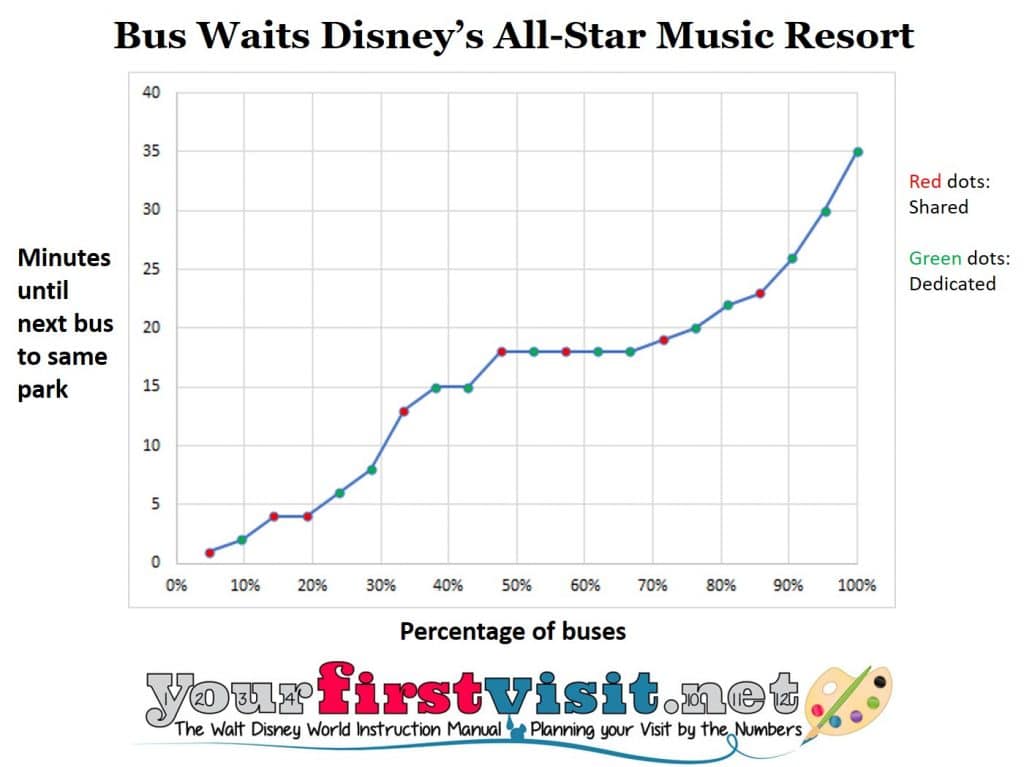

In my January stay at All-Star Music (updated review of All-Star Music begins here), I spent an hour and a half in the middle of the day timing the buses, and noting which were dedicated to Music and which were shared.

(You do that on your Disney World trips too, right?)

I did this because shared buses mean longer trips, because of the extra stops, and create some chance that those waiting at the last stop, All-Star Movies, won’t find a spot.

I timed a total of 32 buses, and here’s the results of my observations:

- All buses to Epcot and ESPN Wide World of Sports were shared

- All buses to Magic Kingdom, Hollywood Studios, and Disney Springs were dedicated to All-Star Music

- Buses to Disney’s Animal Kingdom were about half shared and half dedicated

I had 21 intervals for theme park buses. The average interval was 16 minutes—which means the average wait was 8 minutes.*

However, during my observation there was variation among the parks. The average wait (that is, half the average interval) in my dataset was for Animal Kingdom 4.5 minutes, for Epcot 7 minutes, and 11.5 minutes for each of Hollywood Studios and Magic Kingdom.

While the small sample size means you ought not to read too much into the exact numbers, shared buses had an average wait of 6 minutes and dedicated buses an average wait of 9 minutes.

That suggests pretty comparable experiences in terms of total transportation time, as the shared buses had one more stop to make (at All-Star Movies) than the dedicated buses.

Here’s the overall results, shown my usual way—these are intervals, not waits. Note that almost 80% of buses had an interval of 20 minutes or fewer.

*Because you have an equal chance of arriving anytime during the interval, the average wait is half the interval. The precise math is below:

Follow yourfirstvisit.net on Facebook or Twitter or Pinterest!!

March 11, 2018 No Comments

My Disney Christmas Wish: Half a Billion Dollars for Cast Members

You may not realize it, but tens of thousands of the folks who take care of the rides at Disney World, who drive the boats and buses, who check you in and prep your room, who cook your food and clean your sheets, make, on average, $11.28 an hour ($13.34 after overtime and shift differentials). That’s less than $24,000 a year.

This at a resort where twenty thousand rooms cost from $200 to over $1,000 a night, where four day tickets for a family of four will set you back more than $1,400, and where prices have been skyrocketing for years.

But my back-of-the-envelope calculations suggest the new tax bill will save the Walt Disney Company around $1.5 billion to $2 billion a year, and that the company will in addition have the one time opportunity to repatriate perhaps another $3 billion to $4 billion in overseas earnings.*

So the opportunity is here for Disney to do the right thing, and bring everyone who earns a paycheck on its domestic properties (whether employed by Disney or by a firm to which Disney outsources work) to a minimum of $15 an hour before overtime or shift differentials.

Based on the numbers from here, it’s known that about 36,000 Disney World cast members average $11.28 an hour. Getting them to $15 an hour would cost $3.72 an hour times 2080 hours times 36,000 people, or around $275 million a year.

Expanding this pay increase to all the other Disney World cast members, to the cast members at Disneyland, to all the folks in other domestic parts of the Walt Disney Company who make less than $15 an hour (for example, the folks behind ESPN sports rights negotiation strategy and Star Wars story continuity, it seems), fixing the resulting pay scale compression, taking care of pay-level linked benefits, and then factoring down to adjust for part-timers, I get to the nice round number of the cost to the company of $15 an hour being $500 million a year.

That’s a big number. But with the change in the tax environment, it’s time for a change in the pay environment.

Come on, Disney. It’s time.

*Analysts are still working on these numbers, and Disney may also have to write off certain no-longer-allowed deferred tax assets. But I don’t care, there’s enough.

Follow yourfirstvisit.net on Facebook or Twitter or Pinterest!!

December 25, 2017 4 Comments

Thoughts on The Possibility of More Hotels Getting 60 Day Access to FastPass+

“And of course, we’ve got … a number of other plans as it relates to our hotel business.”

–Bob Iger on Disney’s Q2 earnings call

Note 12/18: this is real.

A couple of weeks ago, Tom Corless at WDW News Today reported that he expected the ability to book FastPass+ at 60 days to be extended to “every hotel in the Disney Springs Resort Area on Hotel Plaza Boulevard” and that “there should also be additional Good Neighbor Hotels on the list when announced by Disney.”

I’ve not written much before about this rumor, but if it is true, there’s a chance it will be announced before or as part of tomorrow’s Q4 and FY2017 earnings call, so I thought I’d put in a bit of context and speculation about impact in advance of that.

WHY DOES FASTPASS+ AT 60 DAYS MATTER

WHY DOES FASTPASS+ AT 60 DAYS MATTER

Disney’s FastPass+ system, fully implemented in 2014, allows you to avoid waits by pre-booking what are essentially appointments at up to three rides per day. So far, anyone with a ticket could begin booking their FastPass+ 30 days before use, and those staying in a Disney-owned hotel or the Swan or Dolphin could begin booking 60 days ahead.

While there’s actually been pretty good availability for most rides at 30 days ahead, those with 60 day rights have a much better chance of getting a FastPass+ for the hottest rides (currently Flight of Passage and Seven Dwarfs Mine Train) and generally have more flexibility in booking their FastPass+ on the days and times that best suit their other Disney World plans.

WHO CURRENTLY GETS FASTPASS+ AT 60 DAYS

There are on the order of 25,400 bookable Disney World owned rooms and another ~2,260 rooms at the Swan and Dolphin, so currently around 27,660 rooms are bookable with the opportunity to get FastPass+ at 60 days. (Shameless plug—for my reviews of all of these, see this.)

HOW MUCH MIGHT ACCESS TO 60 DAY FASTPASS+ EXPAND

There’s three groups of potential additional rooms worth noting:

- Those in the Disney Springs Resort Area, which Tom says should “all” get 60 days FastPass+: seven hotels with around 3,700 rooms.

- The WDW Good Neighbor hotels, which are scattered all over the place to the south and west of the Convention Center, but are largely concentrated in the Palm Parkway and US 192 areas (although you’ll also find them near the Convention Center, in Flamingo Crossing and on Chelonia Parkway, just to the east of Pop Century): 52 hotels with around 17,000* rooms.

- Shades of Green and the Four Seasons, both nearer the core of Disney World than any Disney Springs or Good Neighbor hotel (except maybe for those on Chelonia Parkway), but not part of either of the above two groups. Two hotels with about a thousand rooms between them.

WHAT MIGHT THIS MEAN FOR THOSE BOOKING A HOTEL

If this happens, its impact is profoundly shaped by how many Good Neighbor rooms gain access to FastPass+ at 60 days—and where they are located.

If only the Disney Springs Resort Area hotels and one or the other of Shades and Four Seasons gets 60 day access, then I don’t expect much impact, as the number of eligible rooms would go up only 15% and lower occupancy at the Disney Springs hotels (compared to the Disney owned hotels) would reduce the impact even more.

If these hotels plus all the Good Neighbor hotels get access, then a total of around 21,000 rooms would be added to the FastPass+ at 60 days pool. Correcting this for lower occupancy, and also for the fact that many of the guests of these hotels are in them for reasons other than Disney World (conventions, Universal), the effective total increase is likely on the order of 10,000 rooms, or about a 36% increase. This would make the hottest rides even harder to book, even at 60 days, and would pull more capacity out of the FastPass+ system for those who can only book at thirty days.

But, if this happens, I don’t expect all the Good Neighbor hotels to be in it—as I would expect Disney to be charging them for it, and not all of them would find the extra cost to make business sense.

At least until Star Wars: Galaxy’s Edge opens…

WHY ON EARTH MIGHT DISNEY WORLD DO THIS

I can think of two reasons why Disney might do this, and of course some reasons why it might not.

At the basic level, for the Disney Springs Resort Area hotels, helping them become more attractive would be good for the dining and shopping venues at Disney Springs, into which a lot of capital has been poured over the past few years

Expanding beyond the Disney Springs Resort Area hotels into some or all of the Good Neighbor Hotels (and/or Shades and Four Seasons), if done for a fee charged them by Disney, is a way for Disney to additionally monetize what Disney is likely to view as extremely high incremental hotel stays related to its 2018 Toy Story, 2019 Star Wars and other later Disney World expansions.

Disney World does not have enough capacity in its own hotels (which average nearly 90% occupancy) to serve these incremental guests, and while a couple of additions/expansions are planned/underway, these will also not be sufficient nor even all that timely.

Even more Disney hotels are possible—likely, even—but not in any reasonable timeframe. Moreover, new hotels absorb capital and impose operating risks, which are avoided by monetizing someone else’s capital and operations (this is essentially the logic of DVC, except that Disney fronts the capital which is then bought down by DVC owners).

So expanding access to FastPass+ at 60 days, but charging hotels offering it for the privilege of doing so, would add essentially costless and riskless revenue, which by my back-of-the envelope calculations could easily drop another $100 million a year to Disney World’s bottom line.

WHY IT MIGHT NOT DO THIS

But of course it would not really be costless or riskless, as it would be removing some of the value of the 60 day window at the hotels that currently offer it, diminishing the reason to stay at one of these hotels instead of one of the (typically much less expensive) other hotels newly added to the 60 day FastPass+ window. The fixed cost economics of hotels are such that Disney would lose much more income from a hotel guest who does not stay in one of its own hotels than it could possibly gain from a fee paid by the off-site hotel that that this guest actually stays in.

But recall that the distinctive 60 day window is a perk that’s less than five years old. There are many other good reasons to pay the premium (which can be very high, especially at the moderates and deluxes) to stay in a Disney World hotel besides the 60 day FastPass+ access—I recommended the Disney hotels to first-timers even in the old days when all guests were treated equally in the parks, except for Extra Magic Hours.

And speaking of Extra Magic Hours… The example of Animal Kingdom this summer, when Pandora was open an extra 14 hours a week to Disney World (and Shades of Green and Swan and Dolphin) hotel guests, can be replicated (and expanded, to e.g. 21 or 28 hours) at Hollywood Studios for Toy Story and Star Wars. Differential perks can be added and expanded, so that the Disney-owned hotels can continue to command their premium pricing, which we all complain about on the way to filling them.

*I could not find the size of three of these 52 hotels, so used the average of the other 49 for them; a point of moderate confusion is that these are two different groups—that is, the Disney Springs Resort Area hotels are not WDW Good Neighbor hotels…

Follow yourfirstvisit.net on Facebook or Twitter or Pinterest!!

November 8, 2017 1 Comment